Can you credit it? Getting credit in a recession

27/07/2020

As the economic recovery begins to kick in, the long-term success or failure of many enterprises will depend on their ability to secure credit in a recession and invest now. But have the banks done enough to free up lending?

Gay Sutton separates the truth from the myth.

It’s worth taking a moment to look back at the dramatic events of the financial crisis of 2008. A long established world order was turned on its head.

Banks around the world hit a brick wall, plunging the world into a recession that even slowed the pace of growth in the rampant Chinese economy. After years of profligate lending, many of the great world banks had to be bailed out by their respective Governments and continue today as part-nationalised entities. Meanwhile the likes of the mighty Lehmann Brothers and the ill fated Icelandic banks simply went into administration. Only the few, who had more conservative and measured lending policies, came through the crisis without forfeiting their independence: in the words of the inimitable Bond, shaken but not stirred.

Two and a half years on, as the economies of Europe attempt to claw their way up out of recession, the banking system has undergone significant restructuring. Many governments have launched initiatives to free up bank lending to small and medium sized companies (SMEs), and companies on the whole have been focusing on paying off debt and banking their profits. But as the economic tide turns and companies seek to invest in the upturn, many are reporting difficulties in securing bank funding, complaining about the hoops they are being asked to jump through and the high cost of the loans they are offered.

“After years of profligate lending, many of the great world banks had to be bailed out by their respective Governments and continue today as part-nationalised entities.”

I think there is evidence that there is a spiral of negativity,” said Nick Badman, chair of the Peter Cullum Centre for Entrepreneurship at the Cass Business School, “where small businesses get together, and discuss how dreadful it is that the banks won’t lend money. I think that can put people off applying when they would perhaps get the money if they applied.” So do the banks have funds available and are they willing to invest in business once more?

Ulrich Schürenkrämer, co-head of midmarket business at Deutsche Bank Germany, confirmed that of the loans allocated to the Mittelstand – roughly the equivalent of the SME – €16 billion (£14 billion) have not been drawn. “Which means we still have open lines of some €16 billion We are definitely open to business and we have enough funds available to finance the upswing.”

Andy Grisdale, head of strategy at HSBC commercial Banking UK, commented: “We have been open for business throughout the past two years, and this is evidenced by the fact our balance sheet has grown by 4.2% over the last 12 months. We are also seeing a pickup in demand now.”

Deutsche Bank, Frankfurt, Germany

The HSBC, of course, maintained liquidity and capital throughout the crisis and did not require a government bailout. Yet the NatWest RBS, despite being part nationalised, does not appear to be retentive of its money either. “We’ve lent around £30 billion (€34 billion) to businesses in the last 12 months,” Ibbetson said. “That’s the best part of £100 million (€113 million) a day to SMEs. So we are out there lending, but the demand is still lower than we would want.”If the funds are available for lending, then why do they appear more difficult to secure? Have the lending policies changed?

“Our lending guidelines have not changed materially over the past two years,” said HSBC’s Grisdale. “But is there likely to be more rigour in the process? Absolutely. There are many more fragile businesses around, and the assessment will be somewhat more difficult. To put that in context from a return or risk perspective, with the margins we get from businesses in terms of corrective income, we can’t afford for more than one or two out of every hundred businesses to fail. That’s a very different characteristic to the equity position where you can probably afford about 20% of businesses to fail. So although we have a great appetite to lend money, businesses have to be able to demonstrate a capability to repay that debt. It’s not just about having security; it’s about the ability to repay.”

The banks are also under pressure to reform their business operations and prove their fitness to trade through the so called stress tests run by the Committee of European Banking Supervisors. “In some respects, the banks are in a rather schizophrenic situation,” Badman said. “On one hand they are being urged to rebuild their balance sheets which means being cautious about who they lend to after the previous period of really quite extravagant lending. On the other hand, they have politicians breathing down their necks asking them to lend more money, particularly to small and medium-sized businesses. So there is a huge tension at the centre of this.”

“So although we have a great appetite to lend money, businesses have to be able to demonstrate a capability to repay that debt. It’s not just about having security; it’s about the ability to repay.”

EU_Credit_images_750x400_1

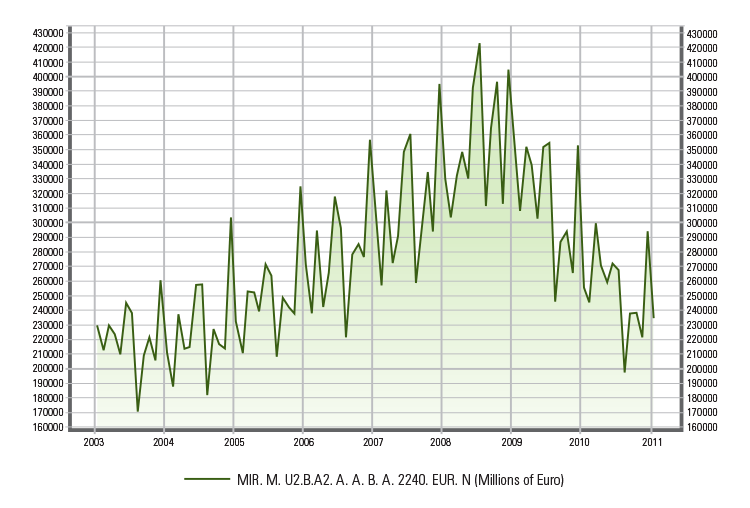

EU_Credit_images_750x400_1Supply of bank funding to European business

The cost of loans is the second big issue, particularly in light of the fact base lending rates are at their lowest in living memory: Bank of England archives show until the 2008 crisis the base lending rate has only dipped as low as 2% once in the past 107 years but it now sits at half a per cent in the UK. From the bank perspective, a significant part of the cost is calculated on the risk attached to the loan, and this is rigorously analysed: the greater the risk, the higher the interest rate.

“We have a common instrument,” explained Schürenkrämer from the Deutsche Bank. “This begins with examining the business on a range of hard and soft facts and then rating it. We need to ascertain whether the company is in a position to repay the financing we will be providing, and this is a very individual analysis. From this, we are able to decide the amount we will lend and the terms of the financing deal. And we are trying to be very transparent about this. We provide our customers with a rate grid so they can see what kind of interest rate they could expect at which credit rating.”

In conclusion, then, there is money available from the banks, and they are keen and able to lend. But the risk assessment process is very rigorous, and loans will only be approved for good business prospects with evidence of a return on investment and a balance sheet that proves the ability to repay the loan. It’s also unlikely that the banks will relax their lending strategies any time soon.

“There is a lot of insecurity in the world right now with the events in Japan and the Arabic world. If you watch the BBC or CNBC, on one side you see there are a lot of problems.” Schürenkrämer concluded. “But on the other side there are a number of opportunities.

“But the risk assessment process is very rigorous, and loans will only be approved for good business prospects with evidence of a return on investment and a balance sheet that proves the ability to repay the loan.”

The most important question is how fit are companies to adjust to the new situations and take advantage of them. From our perspective, if a company’s business case is compelling and shows positive returns on investment, funding is not issue.”

Tips for successfully securing funding

For small business in particular, applying for funding can be a challenging process. “Preparation is key,” said Brian Capon of the British Bankers Association. “It demonstrates to the bank that you are on top of your business, you have your finger on the pulse and that you’re in control. That’s must to the bank’s ears. It won’t guarantee you’ll get the funding, but at least you’ll be giving it your best shot.”

- Business case – a well argued business case supported market research and evidence that all costs and considerations have been taken into account.

- Repayment – evidence that the business will generate sufficient income to repay the loan and meet other financial commitments. A plan B should ROI not materialise.

- Risk assessment – elements that will be considered are: type and size of business, direct competition, business track record, previous credit history, ratios such as how heavily the business is geared and stock turnover.

- Security – willingness to provide security demonstrates commitment to the success of the business.

Source : https://eurekapub.eu/finance/2011/04/15/can-you-credit-it-getting-credit-in-a-recession